The new investment incentives program, which will be effective from the 1st January 2012 comprises 4 different schemes: (1)

1- General Investment Incentive Scheme

2- Regional Investment Incentive Scheme

3- Large Scale Investment Incentive Scheme

4- Strategic Investment Incentive Scheme

The support measures to be provided within the frame of those schemes are summarised in the table below:

| Support Measures | General Investment Incentive Scheme | Regional Investment Incentive Scheme | Large Scale Investment Incentive Scheme | Strategic Investment Incentive Scheme |

| VAT Exemption | ||||

| Customs Duty Exemption | ||||

| Tax Reduction | ||||

| Social Security Premium Support | ||||

| (Employer’s Share) | ||||

| Income Tax Withholding Support * | ||||

| Social Security Premium Support | ||||

| (Employee’s Share) * | ||||

| Interest Support ** | ||||

| Land Allocation | ||||

| VAT Refund |

* Provided that the investment is made in the Region 6.

** Provided that the investment is made in the Regions 3, 4, 5 or 6 within the frame of the Regional Investment Incentive Scheme

THE SUPPORT MEASURES

VAT Exemption:

In accordance with the measure, VAT is not paid for imported and/or domestically provided machinery and equipment within the scope of the investment encouragement certificate.

Customs Duty Exemption:

Customs duty is not paid for the machinery and equipment provided from abroad (imported) within the scope of the investment encouragement certificate.

Tax Reduction:

Calculation of income or corporate tax with reduced rates until the total value reaches to the amount of contribution to the investment according to envisaged rate of contribution.

Social Security Premium Support (Employer’s Share):

The measure stipulates that for the additional employment created by the investment, employer’s share of social security premium on portions of labor wages corresponding to amount of legal minimum wage, will be covered by the Ministry.

Income Tax Withholding Allowance:

The measure stipulates that the income tax regarding the additional employment generated by the investment within the scope of the investment encouragement certificate will not be liable to withholding. The measure is applicable only for the investments to be made in Region 6 within the scope of an investment encouragement certificate.

Social Security Premium Support (Employee’s Share):

The measure stipulates that for the additional employment created by the investment, employee’s share of social security premium on portions of labor wages corresponding to amount of legal minimum wage, will be covered by the Ministry. The measure is applicable only for the investments to be made in Region 6 within the scope of an investment encouragement certificate.

Interest Support:

Interest support, is a financial support instrument, provided for the loans with a term of at least one year obtained within the frame of the investment encouragement certificate. The measure stipulates that a certain portion of the interest/profit share regarding the loan equivalent of at most 70% of the fixed investment amount registered in the certificate will be covered by the Ministry.

Land Allocation:

Refers to allocation of land to the investments with Investment Incentive Certificates, if any in that province in accordance with the rules and principles determined by the Ministry of Finance.

VAT Refund:

VAT collected on the building & construction expenses made within the frame of strategic investments with a fixed investment amount of 500 million TL will be rebated .

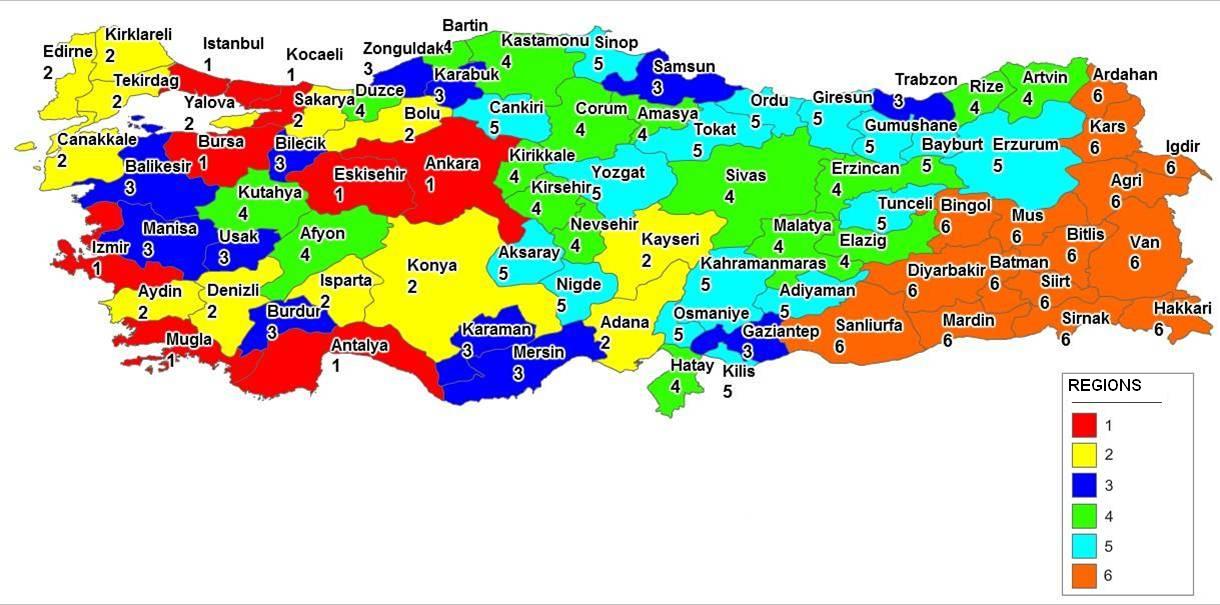

The following Regional Map and Table of Provinces show classification of provinces for the implementation purpose of the Investment Incentives Program

| Region 1 | Region 2 Provinces | Region 3 Provinces | Region 4 Provinces | Region 5 Provinces | Region 6 Provinces |

| Provinces | |||||

| Ankara | Adana | Balıkesir | Afyonkarahisar | Adıyaman | Ağrı |

| Antalya | Aydın | Bilecik | Amasya | Aksaray | Ardahan |

| Bursa | Bolu | Burdur | Artvin | Bayburt | Batman |

| Eskişehir | Çanakkale | Gaziantep | Bartın | Çankırı | Bingöl |

| İstanbul | Denizli | Karabük | Çorum | Erzurum | Bitlis |

| İzmir | Edirne | Karaman | Düzce | Giresun | Diyarbakır |

| Kocaeli | Isparta | Manisa | Elazığ | Gümüşhane | Hakkari |

| Muğla | Kayseri | Mersin | Erzincan | Kahramanmaraş | Iğdır |

| Kırklareli | Samsun | Hatay | Kilis | Kars | |

| Konya | Trabzon | Kastamonu | Niğde | Mardin | |

| Sakarya | Uşak | Kırıkkale | Ordu | Muş | |

| Tekirdağ | Zonguldak | Kırşehir | Osmaniye | Siirt | |

| Yalova | Kütahya | Sinop | Şanlıurfa | ||

| Malatya | Tokat | Şırnak | |||

| Nevşehir | Tunceli | Van | |||

| Rize | Yozgat | ||||

| Sivas | |||||

| 8 PROVINCES | 13 PROVINCES | 12 PROVINCES | 17 PROVINCES | 16 PROVINCES | 15 PROVINCES |

General Investment IncentIves Scheme

Regardless of in which Region an investment is made all projects which meet conditions of specific capacity and the following minimum fixed investment amount will be supported within the frame of the General Investment Incentives Scheme. Investment subjects which are excluded from the investment incentives program can not benefit from this scheme.

The amount of minimum fixed investment is 1 million TL in Region 1 and 2 and 500 thousand TL in Regions 3, 4, 5 and 6.

RegIonal Investment IncentIves Scheme

The sectors to be supported in each province are determined in accordance with potentials of the provinces and the economies of scale and the intensity of the supports are differentiated in line with the development level of the regions.

The amount of minimum fixed investment is defined separately for each sector and each region, the lowest amount being 1 million TL in Regions 1 and 2, and 500 thousand TL in the remaining Regions.

The terms and rates of supports within the Regional Investment Incentives Scheme are summarized in the Table below:

OIZ: Organized Industrial Zones

| REGIONAL INVESTMENTS INCENTIVE SCHEME MEASURES | |||||||||

| INCENTIVE MEASURES | REGIONS | ||||||||

| I | II | III | IV | V | VI | ||||

| VAT Exemption | YES | YES | YES | YES | YES | YES | |||

| Customs Duty Exemption | YES | YES | YES | YES | YES | YES | |||

| Tax Reduction | Rate of Contribution to Investment (%) | Out of OIZ | 15 | 20 | 25 | 30 | 40 | 50 | |

| Within OIZ | 20 | 25 | 30 | 40 | 50 | 55 | |||

| Social Security Premium Support | Support Period | Out of OIZ | 2 years | 3 years | 5 years | 6 years | 7 years | 10 years | |

| (Employer’s Share) | Within OIZ | 3 years | 5 years | 6 years | 7 years | 10 years | 12 years | ||

| Land Allocation | YES | YES | YES | YES | YES | YES | |||

| Interest Support | Local Loans | N/A | N/A | 3 Points | 4 Points | 5 Points | 7 Points | ||

| Foreign Exchange/ | 1 Point | 1 Point | 2 Points | 2 Points | |||||

| FX denominated loans | |||||||||

| Social Security Premium Support | N/A | N/A | N/A | N/A | N/A | 10 years | |||

| (Employee’s Share) | |||||||||

| Income Tax Withholding Support | N/A | N/A | N/A | N/A | N/A | 10 years | |||

Specific priority investment subjects to be supported by measures of Region 5 even they are made in Regions 1, 2, 3 and 4.

– Tourism investments in Cultural and Touristic Preservation and Development Regions determined by the Council of Ministers Decree.

– Mining investments

– Railroad and maritime transportation investments

– Specific pharmaceutical investments and Defense Industry investments with minimum investment amount of 20 Million TL

– Test facilities, wind tunnel and similar investments made for automotive, space or defense industries

– International fairground investments with a minimum covered area of 50.000 m2

– Preschool, Primary, Middle and High School investments by private sector

– Investments made to produce products developed by an R&D Project which is supported by Ministry of Science, Industry and Technology, SME Development Organization or The Scientific and Technological Research Council Of Turkey

– Automotive OEM investments with a minimum investment amount of 300 million TL, automotive engine production investments with a minimum amount of 75 million TL and transmission and parts production and automotive electronics production with a minimum amount of 20 million TL

– Electric production investments which uses IV-b group mines as defined in the Mining Law as input

Large Scale Investment IncentIve Scheme

12 investment categories in the table below are supported by the measures of the Large Scale Investment Incentive Scheme:

| No | Investment Subject | Minimum Investment Amount |

| ( Million TL ) |

||

| 1 | Production of Refined Petroleum Products | 1000 |

| 2 | Production of Chemical Products | 200 |

| 3 | Harbours and Harbour Services | 200 |

| 4 | Automotive OEM and Supply Industries | |

| 4-a | Automotive OEM Investments | 200 |

| 4-b | Automotive Supply Industries Investments | 50 |

| 5 | Railway and Tram Locomotives and/or Railway and Tram Cars |

50 |

| 6 | Transit Pipe Line Transportation Services | |

| 7 | Electronics | |

| 8 | Medical, High Precision and Optical Equipment | |

| 9 | Pharmaceuticals | |

| 10 | Aircraft and Space Vehicles and/or Parts | |

| 11 | Machinery (Including Electrical Machinery and Equipment) |

|

| 12 | Integrated Metal Production |

The terms and rates of supports provided within the Scheme are summarized in the Table below:

OIZ: Organized Industrial Zones

| LARGE SCALE INVESTMENTS INCENTIVE SCHEME MEASURES | ||||||||

| INCENTIVE MEASURES | REGIONS | |||||||

| I | II | III | IV | V | VI | |||

| VAT Exemption | YES | YES | YES | YES | YES | YES | ||

| Customs Duty Exemption | YES | YES | YES | YES | YES | YES | ||

| Tax Reduction | Rate of Contribution to Investment (%) | Out of OIZ | 25 | 30 | 35 | 40 | 50 | 60 |

| Within OIZ | 30 | 35 | 40 | 50 | 60 | 65 | ||

| Social Security Premium Support | Support Period | Out of OIZ | 2 years | 3 years | 5 years | 6 years | 7 years | 10 years |

| (Employer’s Share) | Within OIZ | 3 years | 5 years | 6 years | 7 years | 10 years | 12 years | |

| Land Allocation | YES | YES | YES | YES | YES | YES | ||

| Social Security Premium | N/A | N/A | N/A | N/A | N/A | 10 years | ||

| (Employee’s Share) | ||||||||

| Income Tax Withholding Support | N/A | N/A | N/A | N/A | N/A | 10 years | ||

The following categories of investments within the Regional and Large Scale Investment Incentives Schemes will be supported by more beneficial one level up regional rates and terms of tax reduction and social security premium support (employer’s share):

– Investments in Organized Industrial Zones

– Joint investments to be made by at least 5 companies operating in the same sector with the purpose of integrating these companies to this joint investment

StrategIc Investment IncentIve Scheme

The Goals:

– On the basis of the “Input Supply Strategy”, this scheme aims at supporting production of intermediate and final products with high import dependence with a view to reduce current account deficit.

– It also targets encouraging high-tech and high value added investments with a potential of strengthening Turkey’s international competitiveness.

Investments meeting the criteria below are supported within the frame of the Strategic Investment Incentive Scheme:

– to be made for production of intermediate and final goods with high import dependence of which more than 50% of these goods are supplied by imports,

– to have a minimum investment amount of 50 Million TL,

– to create minimum 40% value added (This condition is not applicable to refined petroleum production investments and petrochemicals production investments),

– to have an import amount of at least $50 Million for goods to be produced in the last one year period (This condition is not applicable to goods with no domestic production)

| STRATEGIC INVESTMENTS INCENTIVE SCHEME MEASURES | |||||||

| INCENTIVE MEASURES | REGIONS | ||||||

| I | II | III | IV | V | VI | ||

| VAT Exemption | YES | ||||||

| Customs Duty Exemption | YES | ||||||

| Tax Reduction | Rate of Contribution to Investment (%) | 50 | |||||

| Social Security Premium Support | Support Period | 7 Years (10 years for 6th region) | |||||

| (Employer’s Share) | |||||||

| Land Allocation | YES | ||||||

| Interest Support | Local Loans | 5 points | |||||

| Foreign Exchange denominated loans | 2 points | ||||||

| Social Security Premium Support | 10 years (only for investments in the Region 6) | ||||||

| (Employee’s Share) | |||||||

| Income Tax Withholding Support | 10 years (only for investments in the Region 6) | ||||||

| VAT Refund | YES | ||||||

| (only for the expanditures of building for investments over 500 milyon TL) |

|||||||

—————————–

(1) Source: Ministry of Economy

MAR

2013